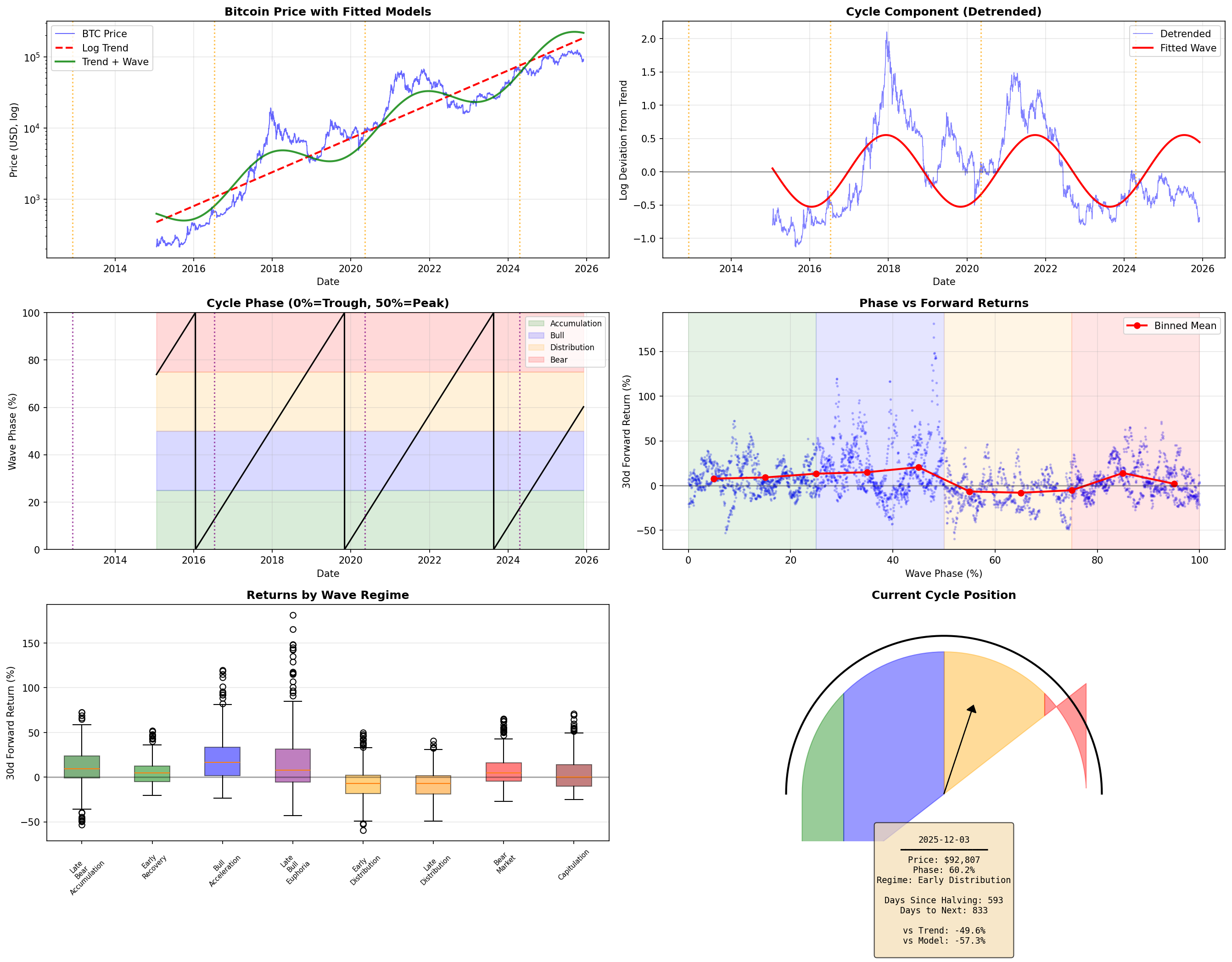

Determine which factors predict Bitcoin forward returns, and establish precedence when signals conflict.

I selected three factors, each representing a different hypothesis about Bitcoin price drivers:

| Factor | Hypothesis | Mechanism |

|---|---|---|

| Power Law | Price follows long-term log growth; deviations mean-revert | Network effects drive adoption along predictable curve |

| Halving Cycle | Supply schedule creates ~4-year market cycles | Block reward halving reduces sell pressure, triggers bull runs |

| Fed/Macro | Bitcoin responds to system-wide liquidity | QE/QT and rate changes flow through to risk assets |

The Power Law and Halving Phase signals conflict. This analysis determined which should take precedence.

Power Law Deviation shows the strongest correlation with 90-day forward returns (-0.449 vs -0.289 for Halving Phase).

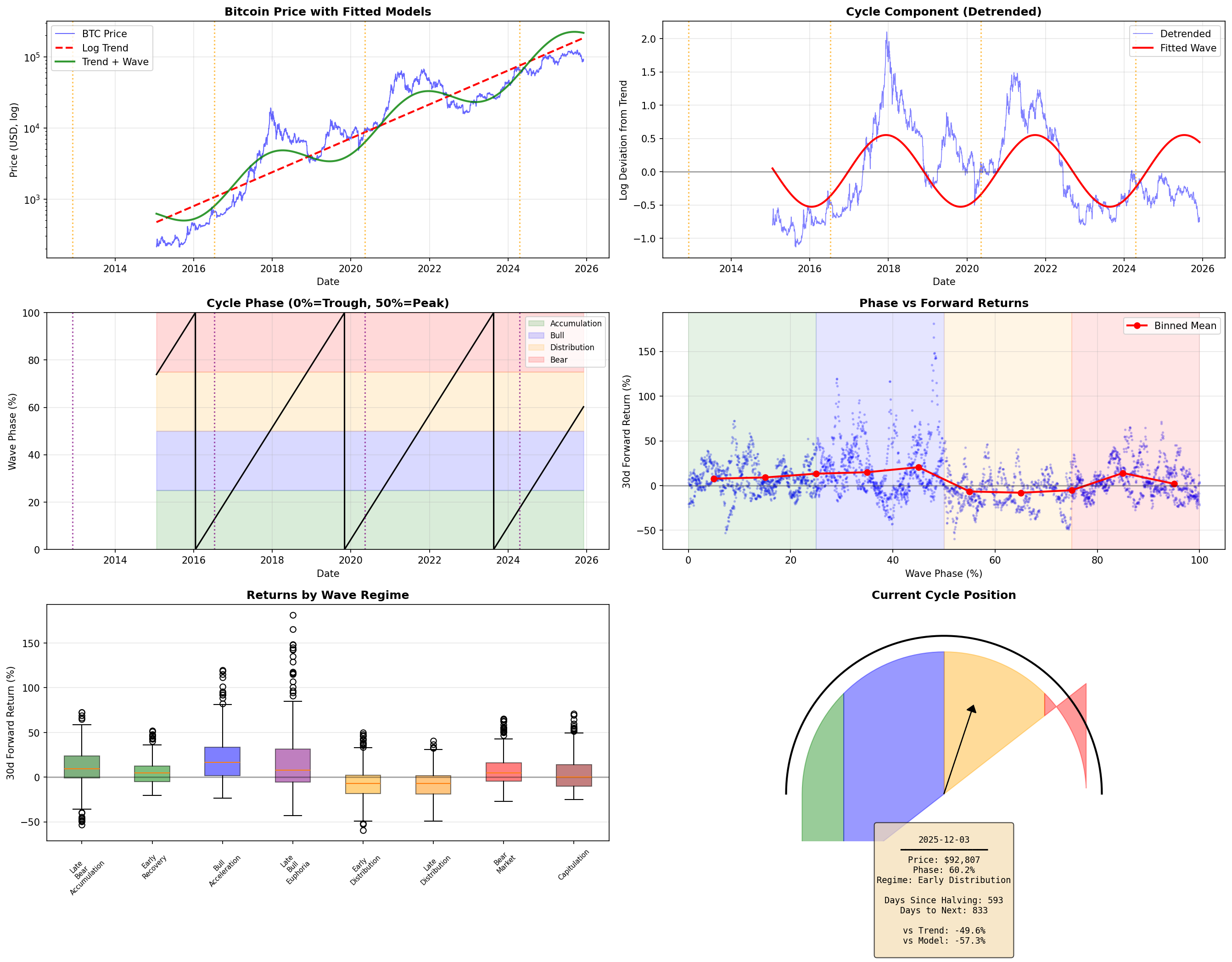

When I tested "undervalued" observations across different phases, results diverged sharply:

| Scenario | Mean 90d Return | Win Rate |

|---|---|---|

| Undervalued + Bull Phase | +50.3% | 100% |

| Undervalued + Distribution | -13.3% | 6.9% |

The same valuation signal produces opposite outcomes depending on phase.

Power Law's aggregate correlation masks regime-dependent performance. It works during Pre-Halving and Bull phases but fails during Distribution. Halving Phase acts as a regime filter that determines whether valuation signals are reliable.

Undervalued + Distribution (n=159):

| Metric | Value |

|---|---|

| Mean 90d return | -16.6% |

| Win rate | 5.7% |

| 95th percentile | +4.2% |

The undervaluation reading is not reliable during Distribution phase. Historical precedent shows 94% of similar setups produced negative 90-day returns.